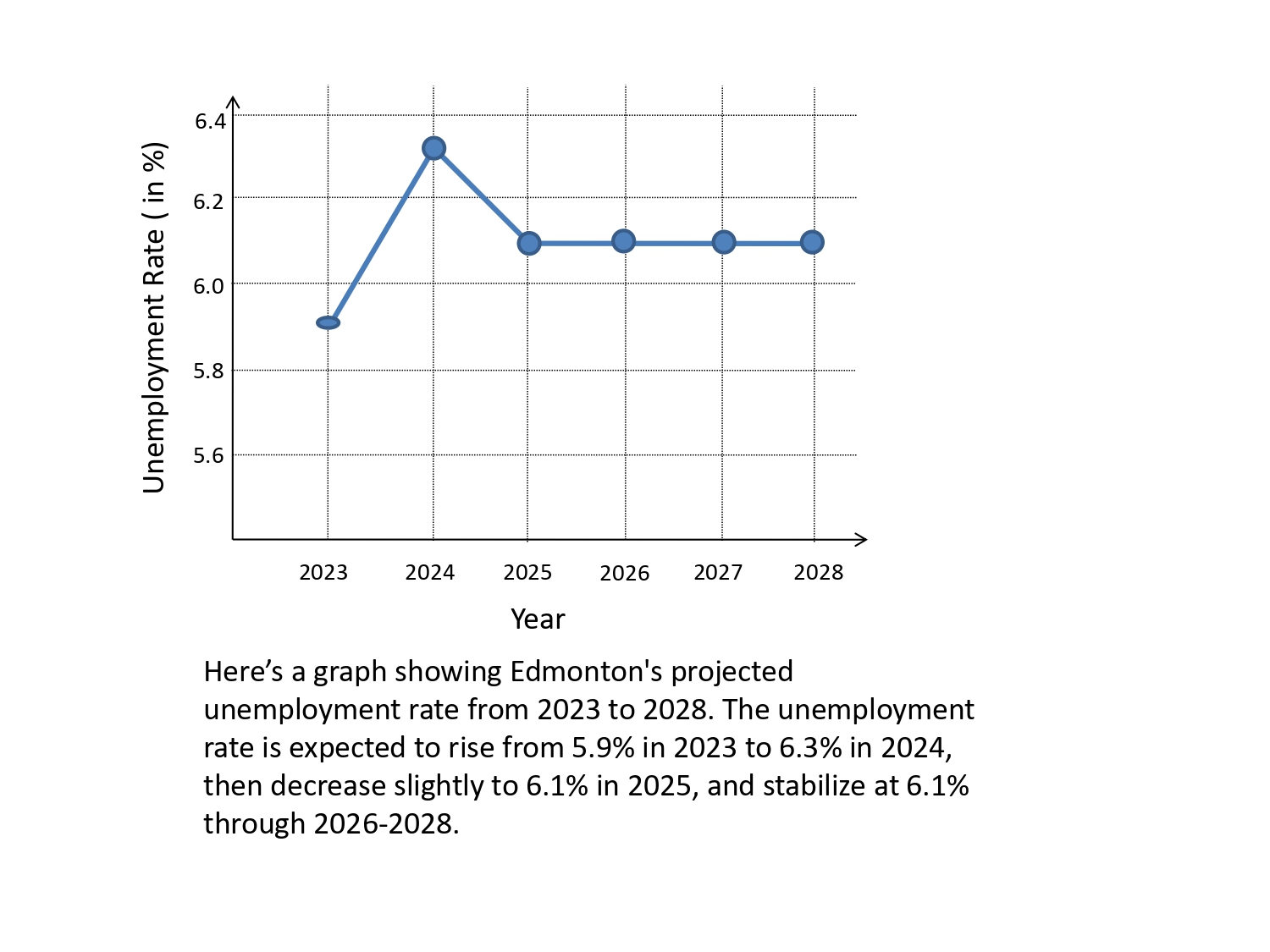

Edmonton’s unemployment rate averaged 5.9 per cent in 2023. The report expects a rise in the unemployment rate to 6.3 per cent in 2024, citing that the labour force increase will be faster than employment. The rate will lower in 2025 to 6.1 per cent and stabilize in 2026-2028, the report said.

Despite a “levelling resale market” in 2023 which will limit output growth in finance, insurance and real estate, the housing market is set to improve later in 2024, which will foster an estimated growth of 3.8 per cent in the finance, insurance and real estate industry in 2025.

Demand for Edmonton homes is being fueled by the “decent” economy and surging population — but faces higher interest rates nationally. While the demand is there, local pricing is unsteady, the report said.

“Against this backdrop, sales have flattened in recent months, while nonetheless exceeding year-earlier levels since July. The area’s resale market remains balanced, although listings are edging up. Rising listings combined with levelling sales could weaken the market’s stance, although we don’t expect a dip into buyers’ territory,” said the report.

The city’s affordability, continuing employment growth and easing interest rates point to a strengthening real estate market in 2024, although the near term looks “rocky.”

While oil remains an important part of Alberta’s economy — oil prices have been trimmed by recession fears and “boosted by Saudi production cuts and war in Israel.” Oil prices in 2023 trimmed output growth in the primary and utility sectors due to volatility to an estimated four per cent in 2023 after annual gains of 7.5 per cent in 2021 and 2022.

“We expect economic cooling and further oil price volatility to limit primary and utilities output growth to 3.1 per cent in 2024 and 2.1 per cent in 2025. The outlook for 2026–28 features 3.1 per cent average annual growth,” said the report.