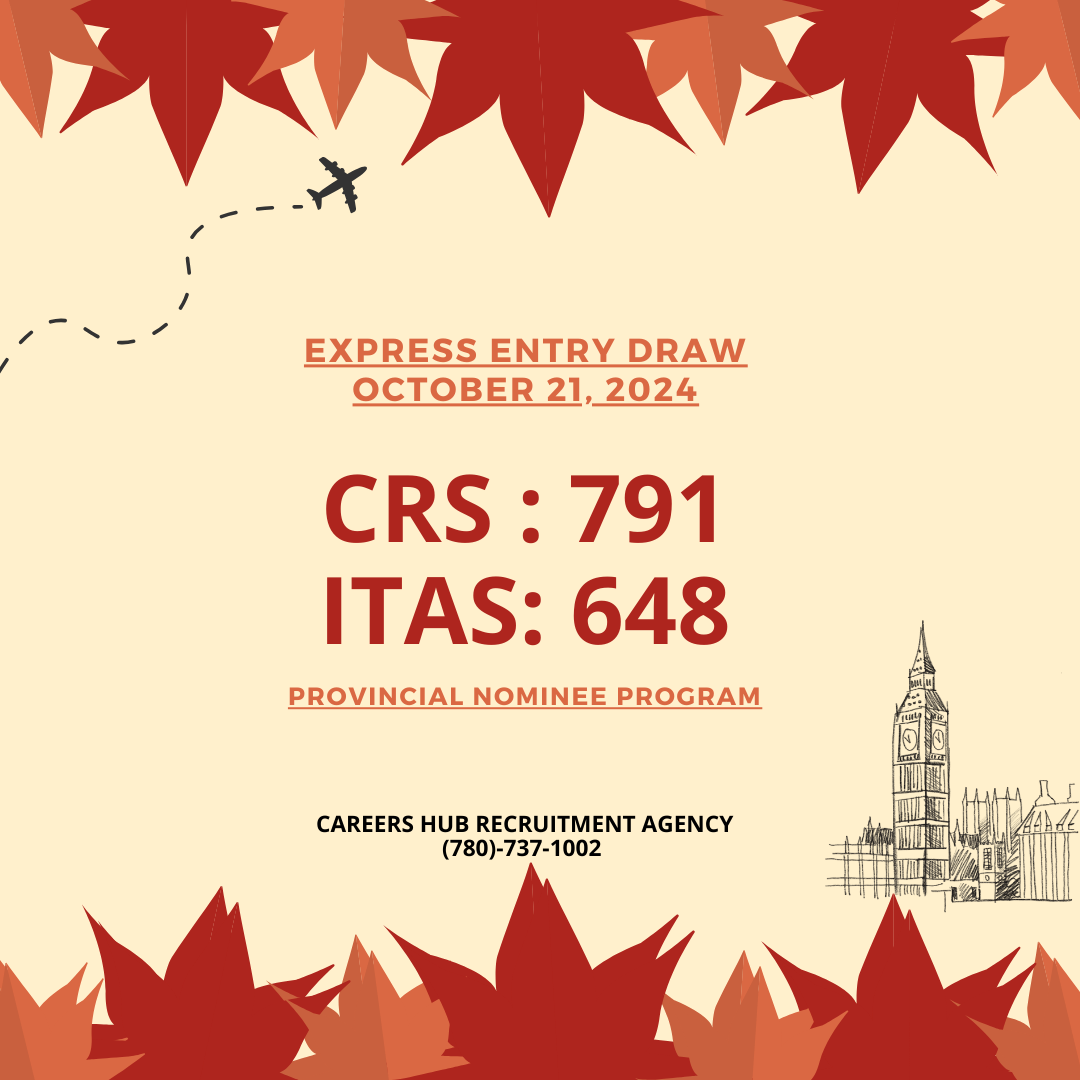

Immigration, Refugees, and Citizenship Canada (IRCC) has issued invitations to apply (ITAs) in the most recent Express Entry draw.

The department issued 733 ITAs in a Provincial Nominee Program (PNP)-aligned draw.

Candidates required a minimum Comprehensive Ranking System (CRS) score of 812 to be considered.

Today’s draw is the first of November and follows the release of Canada’s Immigration Levels Plan for 2025. Under the Plan, IRCC aims to welcome 124,680 Express Entry candidates next year

Those who received an ITA today will be considered in targets for next year, either through the newly introduced In-Canada Focus targets for Express Entry candidates, or the Federal Economic Priorities category.